👋 Hey, Alex here! This is a 🔒 members only article 🔒 of The Imperfect Startup. But good news… in just a few seconds, you can become a member — and it’s free :)

Join thousands of other startup founders getting radically transparent content each week. It’s like having a seat on the board of Groove.

Here’s some members-only exclusive content you’ll be able to access instantly:

- How we Increased Annual Upgrades by 90% in 1 Month - A winning revenue experiment

- $300,000 Down the Drain in 4 Months - A failed activation experiment

Whether you’re at $10K, $100K, or $500K — or even if you’re starting from zero, our goal is to help you learn faster so you can grow faster. See you inside!

From "aha" to "oh shit",

we're revealing it all

we're revealing it all

The startup journey continues. This time, we’re 10X’ing the transparency. Funnel metrics, financials, growth experiments & more — nothing is off-limits. We're learning a lot and so will you.

Groove doesn’t have a board 😉

The first piece of information I’ll share in this Bootstrapped Board Member’s Pack is… we don’t actually have a board!

So, you may ask, why have you bothered to put together a Board Member’s Pack?

Simply put, the information in this pack is Groove’s foundation for growth. It’s a summary of all the data we gathered and analyzed when we finally decided to get serious about growth at Groove.

I also put together this board pack for YOU. I want to give you a complete breakdown of where Groove is at and where we’re headed. And, I want to encourage you to do the same for your startup.

As a member of The Imperfect Startup, you’ll get a Notion template of this Bootstrapped Board Member’s Pack. Use it to create a Board Member’s Pack for your startup — whether you have a board or not ;)

There are six sections in the Bootstrapped Board Member’s Pack:

- Our Go-to-Market Strategy

- Our Cap Table

- Org Structure with Revenue per Employee

- A High-Level Metrics Analysis

- Our Growth Experiment Framework

- Our Bold Growth Goal

Let's dive in!

Groove’s Go-to-Market Strategy

Our Product and Unique Selling Proposition (USP)

Groove is a help desk solution built for small to medium-sized businesses. Our Unique Selling Proposition (USP) can be summarized as follows:

- Groove is simple yet powerful.

- Groove is cost-effective.

- Groove looks and feels just like email.

- Groove is built specifically for smaller companies, not the enterprise.

Our USP is informed by our customers. If you take a look at my calendar for any week, you’ll notice that there will be at least three customer interviews on the schedule. These customer interviews are so valuable because I get to hear the exact words people are using to describe their experiences with using Groove — and other help desk software. In terms of customer research and crafting a product that customers will love, this is gold.

Our USP list is not a wishlist. These are the reasons why our customers convert from a free trial to a paid account.

Our Ideal Customer Profile

Our Ideal Customer Profile (ICP) includes startup founders and early hires in medium-sized companies who own customer support.

They could be scaling out of a shared company email inbox, or they could be getting annoyed with their current help desk because it’s too complicated or too expensive.

Our customers have teams from 2 agents to as many as 50 agents. The average team size of our customers is 5 agents.

Again, we aren’t creating a wishful ICP but rather we’re taking the data we’ve gathered throughout our ten-year history and surfacing the real results to come up with our current ICP.

Product-Led and Content-Driven

Thinking about growth strategies can feel overwhelming and complicated. But it really doesn’t have to be. At Groove, we’re focused on being product-led and content-driven. I believe if we keep focused on these two levers alone, we will be able to reinvigorate our growth.

Being product-led means that we lean on our product to scale business growth, ensuring that it is packed with value for our customers. We’re also constantly working on ways to make the signup and activation steps of our funnel as frictionless as possible and ensuring that our quick-to-wow is well… quick.

Our marketing is content-driven. Our content has always been our main driver for growth and has yielded excellent long-term returns for us. So although we plan on adding to and diversifying our growth levers, creating amazing content will always be our foundation.

Product Market Fit

While I believe the product market fit is ever-evolving, you can see from our numbers below that we’ve achieved some level of PMF.

Our NPS (Net Promoter Score) is currently 29. While that’s a pretty good score, we’re aiming to increase it to a world-class score of between 40 and 50 within the next 12 months.

💡 If your startup is not tracking your NPS, then start today. If you’re a product-led company, then this will be one of the core metrics you’ll use to track retention and referrals.

Groove’s Cap Table

As Founder and CEO, I own 85% of the company. I used the profits I’d made from the sale of my previous company as the seed capital for Groove. That set the tone for Groove’s funding model. We’ve predominantly been a bootstrapped, self-funded company. At one point, I took on some angel investment, but I’ve since paid back that investment, which equated to $1.75M.

The remainder of the company’s shares are owned by other silent partners (10%) and our employees (5%).

Every founder wants more of the cap table, but it’s important to understand your goals and how they relate to a cap table.

There’s no right or wrong here. In paying back my investors, I opted for the long play. It cost me in the short term, but it was important to me to own more of the company and have the long-term personal financial freedom that came along with that.

You might have different goals — and so your cap table will look different to mine. For example, if you have one or more co-founders and then you choose to raise an A-round (or even just take on angel investment), then your slice of that cap table will go down accordingly. If you also have the goal of achieving long-term financial freedom through your business, then the reality is that you and your co-founders are going to have to build a 100M+ business.

Our Organizational Structure

At $4.2MM ARR, we run Groove with a very small, lean team. At the time of this writing, we have 12 full-time employees and three contractors/agencies who play pivotal roles in Groove’s operations

Alex Turnbull (Founder & CEO)

| Engineering | Customer Support | Marketing | ||||

|---|---|---|---|---|---|---|

Cindy Chan (Frontend Engineer) Jared Scheel (Full-Stack Engineer) Kevin Rademan (Full-Stack Engineer) Konrad Janczyk (Full-Stack Engineer) Matt Beedle (Ops Engineer) Piotr Klupa (Full-Stack Engineer) Tayo Agagu (Full-Stack Engineer) Yao Chan (Frontend Engineer) | Adri Jordaan (Customer Support) Graham Pitout (Head of Customer Support) | Dmitry Dragilev (SEO Consultant) Hey Friends (YouTube Channel Producers) Martin Roberts (UX/UI Designer) Shelley Smith (Managing Editor) | ||||

Our Total Staffing Expense (including both full-time employees and contractors) is $94,794.99 / month.

On average, our Revenue per Staff Member (employees and contractors) is $287,000.

| Total Staffing Expense | Average Revenue per Staff Member |

|---|---|

| $94,794.99 | $287,000 |

I believe that our small, lean team is one of the main drivers of Groove’s profitability and our overall success over the last ten years.

So while I plan on making a few strategic new hires in the year ahead, I don’t expect the team to grow by more than five people.

The roles I’ll be hiring for will be informed by the biggest opportunities in the business and we have discovered those opportunities through analysis of our metrics.

So in the next section, I’ll take you through a high-level analysis of our metrics.

💡It’s a mistake to equate headcount with success. At one point, I had more than 30 people on the Groove team, but I consider us far more successful (and effective!) now with our 12-person team.

High-Level Metrics Analysis

One of the fundamental changes we’ve made at Groove in recent years is never to rely on guesses or gut feelings. We make decisions based on metrics. Our metrics tell a story about where we’ve come from and how we can get to where we’re going.

Revenue Metrics

Our current MRR (as of August 2023) is $359K. In April 2016, we were at the $100K MRR (Monthly Recurring Revenue) mark. We’ve grown about 300% over the last seven years.

Our ARR (Annual Recurring Revenue) reflects that, going from $1MM ARR to $4.2MM ARR in the same seven-year period.

I’m happy with that. But I’m not satisfied with it either. We’ve been hanging out in the $300K MRR neighborhood for too long now and I know Groove is capable of more.

Looking at some of these key revenue metrics you can clearly see where the biggest opportunity for growth lies for Groove.

Our revenue churn is healthy but we need to focus on the bottle necks happening in our activation.

We simply need more net new customers. 23 new customers a month just isn’t going to cut it.

Our funnel metrics in the next section further illustrate this point.

Funnel Metrics Analysis

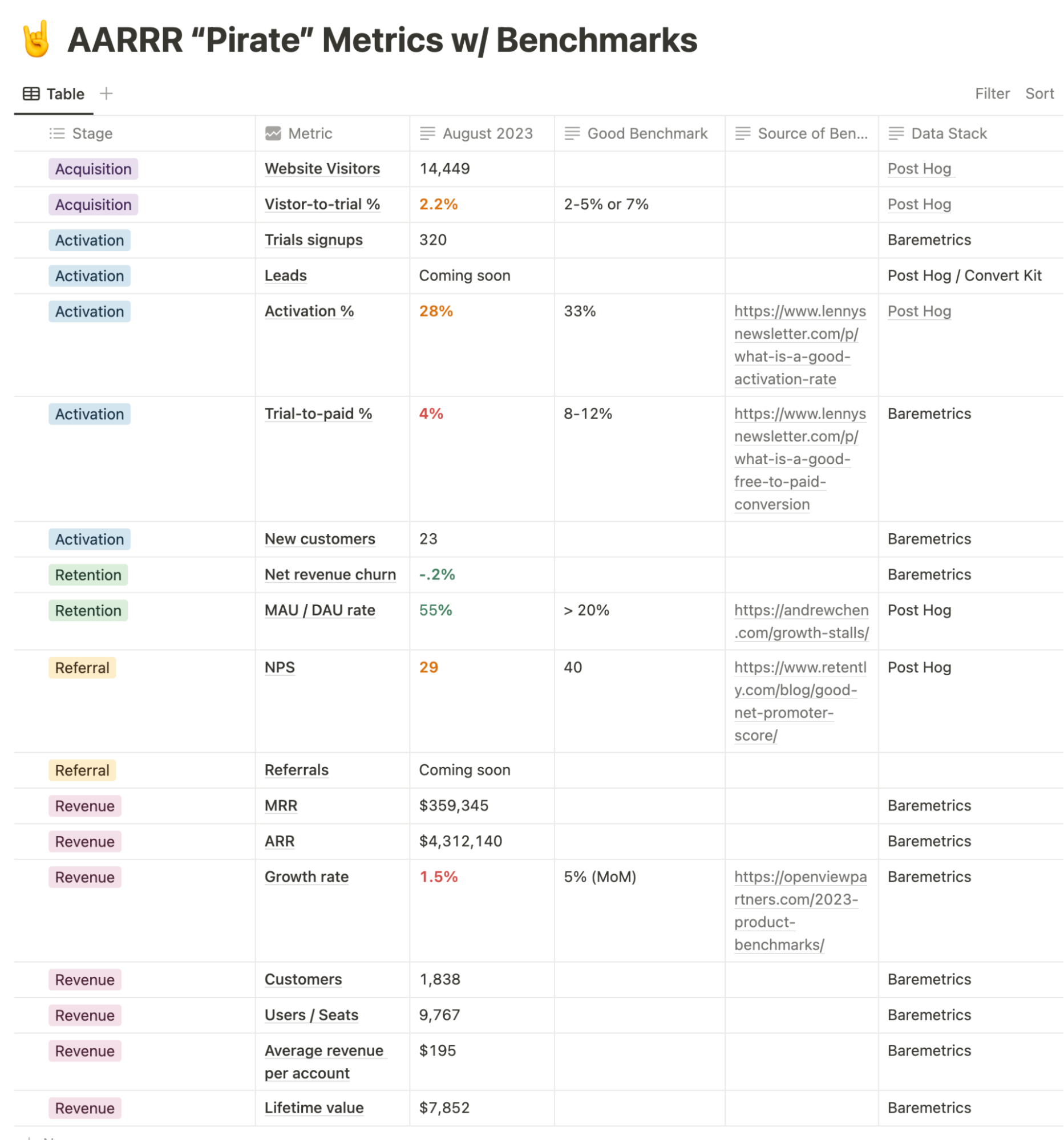

To get an idea of our funnel metrics, here’s a screenshot of a template in Notion I use each month to assess how Groove is tracking against industry benchmarks. Steal this template for your own startup!

As you can see here, the biggest opportunity is again a function of that trial-to-paid %. Our retention rate, NPS, net revenue churn and MAU / DAU rate are strong.

There’s also work to be done at the acquisition stage (hence the launch of this new crazy content series!).

For us, it’s all about the basic marketing funnel. More traffic, better visitor-to-trial conversions, more activation (quick to wow), and increasing trial-to-paid.

Profit Margin and Rule of 40

The last metric I’m going to share with you is the one that every board member would need to know — that is our gross profit margin.

I’m proud of our EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization). We typically run at a monthly EBITDA of between 35% and 45%, which makes Groove a very profitable company. According to the Rule of 40, our EBITDA percentage is in the right region.

Some will say that I have a nice lifestyle business on my hands — and I wouldn’t disagree. But as we enter a new era of growth, I've been challenged to sacrifice some of our profits in pursuit of growth.

In the coming months, we’re going to be spending more money on growth experiments which have a high likelihood of achieving the results we’re aiming for (more on that later). We’re also planning on expanding our team and hiring people who will directly drive growth for Groove.

Overall insights from metrics analysis

At $4.2MM ARR and a profit margin of between 35 and 45%, we’ve got an excellent foundation from which to work. But “work” is the keyword there.

There are wide gaps between the benchmarks and what Groove is currently achieving. As CEO, I’ll admit that it doesn’t feel great looking at our acquisition metrics. But those metrics are also telling me a story about my company.

That “story” is that if we really want to grow Groove, then the opportunity lies at the basic parts of our marketing funnel. If we can improve our activation and acquisition metrics, then we can achieve that month-over-month revenue growth rate we’re aiming for.

So what next? How can we leverage the opportunities we’ve uncovered in our metrics? By running growth experiments.

Growth Experiment Framework

Our growth experiment framework is entirely informed by the metrics analysis I’ve just taken you through.

In the past, we’ve been guilty of trying out tactics just because they sounded cool or because of a gut feeling that they’d deliver success. That’s an unreliable plan at best — and at worst, it could lead to the downfall of a business.

Here’s a screenshot of the growth experiments that we’re currently working on.

As you can see, each experiment is tied to a stage in the funnel (Activation, Acquisition, Retention, Revenue, or Referral) and a funnel metric that we’re targeting.

We’re very excited about our growth experiment framework and here are three reasons why…

We’re (finally) focusing on growth

Here’s my guilty admission: Groove has never been intentional about growth. We’ve grown organically. We’ve had loyal customers who stick around and refer their friends. Our content marketing from years back has continued to bring us new customers, without us having to put too much effort into growth.

But if we want to completely uplevel our growth (and when you see our goals at the end of this post, you’ll be in no doubt that we are on a mission to GROW), then we cannot be passive about our growth.

Now for the first time in Groove’s history, we’re conducting the 101 growth experiments that all B2B SaaS companies should be running. Examples of the type of experiments I’m talking about are:

- A/B Testing more prominent customer validation on our homepage

- SEO Campaign targeting “help desk software”

- Having an interactive demo available on our marketing site

- Offering a Freemium Plan

- Testing simplified vs. longer onboarding sequences

- Having a lead magnet on our marketing site for the 80% of visitors that aren’t ready to buy yet

We’re working together on key metrics

Because our experiments are so clearly tied to improving our key metrics, there’s a sense across the team that we’re all working on stuff that matters. That’s amazing for team morale.

And a quick sidebar here: If you’re a startup founder or CEO, then please, check your metrics. Often.

The tactics that are going to drive growth for your company might not be the same tactics that drive growth for us at Groove (and vice versa). But if you look at your company’s metrics (and I’m talking about really analyzing them), you’ll be able to see where your opportunities for growth lie and design growth experiments to leverage those opportunities.

We’re sharing our growth journey — in real time

Our growth experiment framework also provides us with a content framework for The Imperfect Startup.

Right now, our experiments are in their early stages. Many of them haven’t even kicked off yet or we’re busy building them out in PostHog. But The Imperfect Startup is all about growth in real time. As we have results and as we start noticing trends, you’ll be the first to know (as long as you’ve subscribed, of course).

Groove’s Bold Growth Goal

It’s taken us roughly 7 years to grow from $1MM ARR to $4.2MM ARR. That’s not rapid growth by any means. In fact, according to Chart Mogul’s SaaS Benchmarks Report, we’re placed in the lowest quartile for ARR growth rates.

But as I’ve admitted already, Groove has never been intentional about growth.

We’ve got our problems — a low growth rate, a trial-to-paid metric well below the benchmark, and a visitor-to-trial rate that could certainly be better. But we’ve got so much going for us too — besides our potential, we’ve got a strong foundation that would be the envy of many startups or scale-ups. We’re very profitable, we have good retention rates, and our product-market fit means that we have a consistent, respectable MRR.

We can work with that! I can work with that — in fact, I’m making it my life’s mission!

“It makes me happy when I see strong retention numbers with a flat growth curve. Funny enough, I consider this a very good thing. The history of fixing these situations is much better, and the approach is usually quite simple: Find more marketing channels, and scale existing ones. And if you can, find a self-repeating growth loop where users sign up for your product, use it, and then help generate more signups over time.”

I believe that if Groove can do as Andrew suggests and find more marketing channels — not necessarily based on the latest trends, but rather on the opportunities we uncover in our metrics, then we can grow Groove.

We’ve also got existing growth channels that have been very effective for us in the past. We’re going to be ramping those up, big time.

It comes down to this: What if we finally get serious about growth at Groove?

You’ll find out the answer to that question in two years’ time. Because in the next two years, we have our sights set on doubling our ARR from $4M to $8M.

It’s a lofty goal. Some might say it’s delusional. But my money’s on that we can do it (and given that I own 85% of the company, I mean that quite literally).

In the time between now and October 2025, you can follow our quest right here at The Imperfect Startup(you’ve signed up for your weekly updates, right?).

Groove’s Growth Pillars

If it’s not clear already, revenue growth is our top priority at Groove for the next two years.

We’re using the following five growth pillars to give structure to our growth ambitions. If you’re intrigued by any of them, then make sure you’re signed up for The Imperfect Startup Newsletter, because I’ve got plenty more content coming down the pipeline on these topics.

- The whole company now has a growth mindset. We’re constantly learning, iterating and improving. Making smart rational decisions.

- Those smart rational decisions that we’re making now come from being 100% metrics-driven — gone are the days of coming up with an idea off the cuff. Everything has to be tied back to our goals and metrics.

- We’ve created a growth experiment framework and we’re executing 101 B2B SaaS growth experiments that are tied to key growth metrics.

- We’re going to start to build out a growth team to help us crush our growth goals and experiments.

- And to keep us honest, we’re sharing the ups and downs of our growth journey with radical transparency right here on The Imperfect Startup.

That last point is possibly the one we’re most excited about. Working in the open and sharing the journey has always been a part of how we do things here at Groove and we are pumped to have you along for the ride.

Whether you’re at $10K, $100K, or $500K MRR — or even if you’re starting from zero, we’re here for you.

So go ahead and subscribe to The Imperfect Startup. You’ll be joining so much more than just another newsletter — it’s a community, a movement, a joint mission to grow each of our startups, imperfectly.

From "aha" to "oh shit",

we're revealing it all

we're revealing it all

The startup journey continues. This time, we’re 10X’ing the transparency. Funnel metrics, financials, growth experiments & more — nothing is off-limits. We're learning a lot and so will you.